Snapshot of - GEM-E3

Archive of GEM-E3, version: _092019

Reference card - GEM-E3

The reference card is a clearly defined description of model features. The numerous options have been organized into a limited amount of default and model specific (non default) options. In addition some features are described by a short clarifying text.

Legend:

- not implemented

- implemented

- implemented (not default option)

About

Name and version

GEM-E3 _092019

Model link

Institution

Institute of Communication And Computer Systems (ICCS), Greece, https://www.iccs.gr/en/.

Documentation

GEM-E3 documentation consists of a referencecard and detailed model documentation

Process state

published

Model scope and methods

Model documentation: Model scope and methods - GEM-E3

Model type

- Integrated assessment model

- Energy system model

- CGE

- CBA-integrated assessment model

Geographical scope

- Global

- Regional

Objective

The GEM-E3 model is a multi-regional, multi-sectoral, recursive dynamic hybrid computable general equilibrium (CGE) model which provides details on the macro-economy and its interaction with the environment and the energy system. It incorporates micro-economic mechanisms and institutional features within a consistent macro-economic framework.

Solution concept

- Partial equilibrium (price elastic demand)

- Partial equilibrium (fixed demand)

- General equilibrium (closed economy)

Solution horizon

- Recursive dynamic (myopic)

- Intertemporal optimization (foresight)

Solution method

- Simulation

- Optimization

Temporal dimension

Base year:2014, time steps:5, horizon: 2100

Spatial dimension

Number of regions:46

Time discounting type

- Discount rate exogenous

- Discount rate endogenous

Policies

- Emission tax

- Emission pricing

- Cap and trade

- Fuel taxes

- Fuel subsidies

- Feed-in-tariff

- Portfolio standard

- Capacity targets

- Emission standards

- Energy efficiency standards

- Agricultural producer subsidies

- Agricultural consumer subsidies

- Land protection

- Pricing carbon stocks

Socio-economic drivers

Model documentation: Socio-economic drivers - GEM-E3

Population

- Yes (exogenous)

- Yes (endogenous)

Population age structure

- Yes (exogenous)

- Yes (endogenous)

Education level

- Yes (exogenous)

- Yes (endogenous)

Urbanization rate

- Yes (exogenous)

- Yes (endogenous)

GDP

- Yes (exogenous)

- Yes (endogenous)

Income distribution

- Yes (exogenous)

- Yes (endogenous)

Employment rate

- Yes (exogenous)

- Yes (endogenous)

Labor productivity

- Yes (exogenous)

- Yes (endogenous)

Total factor productivity

- Yes (exogenous)

- Yes (endogenous)

Autonomous energy efficiency improvements

- Yes (exogenous)

- Yes (endogenous)

Macro-economy

Model documentation: Macro-economy - GEM-E3

Economic sector

Industry

- Yes (physical)

- Yes (economic)

- Yes (physical & economic)

Energy

- Yes (physical)

- Yes (economic)

- Yes (physical & economic)

Transportation

- Yes (physical)

- Yes (economic)

- Yes (physical & economic)

Residential and commercial

- Yes (physical)

- Yes (economic)

- Yes (physical & economic)

Agriculture

- Yes (physical)

- Yes (economic)

- Yes (physical & economic)

Forestry

- Yes (physical)

- Yes (economic)

- Yes (physical & economic)

Other economic sector

- other

Macro-economy

Trade

- Coal

- Oil

- Gas

- Uranium

- Electricity

- Bioenergy crops

- Food crops

- Capital

- Emissions permits

- Non-energy goods

- All other major traded economic activities (40 economic sectors)

- Energy goods

Note: The model links all countries and sectors through endogenous bilateral trade transactions.

Cost measures

- GDP loss

- Welfare loss

- Consumption loss

- Area under MAC

- Energy system cost mark-up

- Equivalent Variation

Categorization by group

- Income

- Urban - rural

- Technology adoption

- Age

- Gender

- Education level

- Household size

Institutional and political factors

- Early retirement of capital allowed

- Interest rates differentiated by country/region

- Regional risk factors included

- Technology costs differentiated by country/region

- Technological change differentiated by country/region

- Behavioural change differentiated by country/region

- Constraints on cross country financial transfers

Resource use

Coal

- Yes (fixed)

- Yes (supply curve)

- Yes (process model)

Conventional Oil

- Yes (fixed)

- Yes (supply curve)

- Yes (process model)

Unconventional Oil

- Yes (fixed)

- Yes (supply curve)

- Yes (process model)

Conventional Gas

- Yes (fixed)

- Yes (supply curve)

- Yes (process model)

Unconventional Gas

- Yes (fixed)

- Yes (supply curve)

- Yes (process model)

Uranium

- Yes (fixed)

- Yes (supply curve)

- Yes (process model)

Bioenergy

- Yes (fixed)

- Yes (supply curve)

- Yes (process model)

Water

- Yes (fixed)

- Yes (supply curve)

- Yes (process model)

Raw Materials

- Yes (fixed)

- Yes (supply curve)

- Yes (process model)

Land

- Yes (fixed)

- Yes (supply curve)

- Yes (process model)

Technological change

Energy conversion technologies

- No technological change

- Exogenous technological change

- Endogenous technological change

Energy End-use

- No technological change

- Exogenous technological change

- Endogenous technological change

Material Use

- No technological change

- Exogenous technological change

- Endogenous technological change

Agriculture (tc)

- No technological change

- Exogenous technological change

- Endogenous technological change

Other technological change

- Other: Total factor productivity, Labour productivity, Capital productivity are all exogenous. Semi-endogenous TFP for clean technologies based on learning by doing and learning by research

Energy

Model documentation: Energy - GEM-E3

Energy technology substitution

Energy technology choice

- No discrete technology choices

- Logit choice model

- Production function

- Linear choice (lowest cost)

- Lowest cost with adjustment penalties

Energy technology substitutability

- Mostly high substitutability

- Mostly low substitutability

- Mixed high and low substitutability

Energy technology deployment

- Expansion and decline constraints

- System integration constraints

Energy

Electricity technologies

- Coal w/o CCS

- Coal w/ CCS

- Gas w/o CCS

- Gas w/ CCS

- Oil w/o CCS

- Oil w/ CCS

- Bioenergy w/o CCS

- Bioenergy w/ CCS

- Geothermal power

- Nuclear power

- Solar power

- Solar power-central PV

- Solar power-distributed PV

- Solar power-CSP

- Wind power

- Wind power-onshore

- Wind power-offshore

- Hydroelectric power

- Ocean power

Hydrogen production

- Coal to hydrogen w/o CCS

- Coal to hydrogen w/ CCS

- Natural gas to hydrogen w/o CCS

- Natural gas to hydrogen w/ CCS

- Oil to hydrogen w/o CCS

- Oil to hydrogen w/ CCS

- Biomass to hydrogen w/o CCS

- Biomass to hydrogen w/ CCS

- Nuclear thermochemical hydrogen

- Solar thermochemical hydrogen

- Electrolysis

Refined liquids

- Coal to liquids w/o CCS

- Coal to liquids w/ CCS

- Gas to liquids w/o CCS

- Gas to liquids w/ CCS

- Bioliquids w/o CCS

- Bioliquids w/ CCS

- Oil refining

Refined gases

- Coal to gas w/o CCS

- Coal to gas w/ CCS

- Oil to gas w/o CCS

- Oil to gas w/ CCS

- Biomass to gas w/o CCS

- Biomass to gas w/ CCS

Heat generation

- Coal heat

- Natural gas heat

- Oil heat

- Biomass heat

- Geothermal heat

- Solarthermal heat

- CHP (coupled heat and power)

Grid Infra Structure

Electricity

- Yes (aggregate)

- Yes (spatially explicit)

Gas

- Yes (aggregate)

- Yes (spatially explicit)

Heat

- Yes (aggregate)

- Yes (spatially explicit)

CO2

- Yes (aggregate)

- Yes (spatially explicit)

Hydrogen

- Yes (aggregate)

- Yes (spatially explicit)

Energy end-use technologies

Passenger transportation

- Passenger trains

- Buses

- Light Duty Vehicles (LDVs)

- Electric LDVs

- Hydrogen LDVs

- Hybrid LDVs

- Gasoline LDVs

- Diesel LDVs

- Passenger aircrafts

Freight transportation

- Freight trains

- Heavy duty vehicles

- Freight aircrafts

- Freight ships

Industry

- Steel production

- Aluminium production

- Cement production

- Petrochemical production

- Paper production

- Plastics production

- Pulp production

- Other: Equipment goods, Non-metalic minnerals, Consumer goods industries

Residential and commercial

- Space heating

- Space cooling

- Cooking

- Refrigeration

- Washing

- Lighting

Land-use

Model documentation: Land-use - GEM-E3

Land cover

- Cropland

- Cropland irrigated

- Cropland food crops

- Cropland feed crops

- Cropland energy crops

- Forest

- Managed forest

- Natural forest

- Pasture

- Shrubland

- Built-up area

Agriculture and forestry demands

- Agriculture food

- Agriculture food crops

- Agriculture food livestock

- Agriculture feed

- Agriculture feed crops

- Agriculture feed livestock

- Agriculture non-food

- Agriculture non-food crops

- Agriculture non-food livestock

- Agriculture bioenergy

- Agriculture residues

- Forest industrial roundwood

- Forest fuelwood

- Forest residues

Agricultural commodities

- Wheat

- Rice

- Other coarse grains

- Oilseeds

- Sugar crops

- Ruminant meat

- Non-ruminant meat and eggs

- Dairy products

Emission, climate and impacts

Model documentation: Emissions - GEM-E3, Climate - GEM-E3, Non-climate sustainability dimension - GEM-E3

Greenhouse gases

- CO2 fossil fuels

- CO2 cement

- CO2 land use

- CH4 energy

- CH4 land use

- CH4 other

- N2O energy

- N2O land use

- N2O other

- CFCs

- HFCs

- SF6

- PFCs

Pollutants

- CO energy

- CO land use

- CO other

- NOx energy

- NOx land use

- NOx other

- VOC energy

- VOC land use

- VOC other

- SO2 energy

- SO2 land use

- SO2 other

- BC energy

- BC land use

- BC other

- OC energy

- OC land use

- OC other

- NH3 energy

- NH3 land use

- NH3 other

Climate indicators

- Concentration: CO2

- Concentration: CH4

- Concentration: N2O

- Concentration: Kyoto gases

- Radiative forcing: CO2

- Radiative forcing: CH4

- Radiative forcing: N2O

- Radiative forcing: F-gases

- Radiative forcing: Kyoto gases

- Radiative forcing: aerosols

- Radiative forcing: land albedo

- Radiative forcing: AN3A

- Radiative forcing: total

- Temperature change

- Sea level rise

- Ocean acidification

Note: GEM-E3 model does not include climate indicators.

Carbon dioxide removal

- Bioenergy with CCS

- Reforestation

- Afforestation

- Soil carbon enhancement

- Direct air capture

- Enhanced weathering

Climate change impacts

- Agriculture

- Energy supply

- Energy demand

- Economic output

- Built capital

- Inequality

Co-Linkages

- Energy security: Fossil fuel imports & exports (region)

- Energy access: Household energy consumption

- Air pollution & health: Source-based aerosol emissions

- Air pollution & health: Health impacts of air Pollution

- Food access

- Water availability

- Biodiversity

Model Documentation - GEM-E3

1) Model scope and methods - GEM-E3

The General Equilibrium Model for Economy-Energy-Environment (GEM-E3) is a multi-regional, multi-sectoral, recursive dynamic computable general equilibrium (CGE) model which provides details on the macro-economy and its interaction with the environment and the energy system. It is an empirical, large scale model written entirely in structural form.

GEM-E3 incorporates micro-economic mechanisms and institutional features within a consistent macro-economic framework and avoids the representation of behaviour in reduced form. The GEM-E3 model includes projections of: full Input-Output tables by country/region, national accounts, employment, balance of payments, public finance and revenues, household consumption, energy use and supply, GHG emissions and atmospheric pollutants.

The model features perfect competition market regimes, discrete representation of power producing technologies, semi-endogenous learning by doing effects, equilibrium unemployment, option to introduce energy efficiency standards, formulates emission permits for GHG and atmospheric pollutants. The environmental module includes flexibility instruments allowing for a variety of options when simulating emission abatement policies, including: different allocation schemes (grandfathering, auctioning, etc.), user-defined bubbles for traders, various systems of exemptions, various systems for revenue recycling, etc.

1.1) Model concept, solver and details - GEM-E3

The scope of GEM-E3 is general in two terms: it includes all simultaneously interrelated markets and represents the system at the appropriate level with respect to geography, the sub-system (energy, environment, economy) and the dynamic mechanisms of agent’s behaviour.

The model is not limited to comparative static evaluation of policies. The model is dynamic in the sense that projections change over time. Its properties are mainly manifested through stock/flow relationships, technical progress, capital accumulation and agents’ (myopic) expectations.

The design of GEM-E3 model has been developed following four main guidelines:

• Model design around a basic general equilibrium core in a modular way so that different modelling options, market regimes and closure rules are supported by the same model specification

• Fully flexible (endogenous) coefficients in production and in consumer’s demand

• Calibration to a base year data set, incorporating detailed Social Accounting Matrices as statistically observed

• Dynamic mechanisms, through the accumulation of capital stock.

The GEM-E3 model starts from the same basic structure as the standard World Bank models. Following the tradition of these models, GEM-E3 is built on the basis of a Social Accounting Matrix (SAM). The model is calibrated to a base year data set that comprises a full SAM for each country/region represented in the model. Bilateral trade flows are also calibrated for each sector represented in the model, taking into account trade margins and transport costs. Consumption and investment is built around transition matrices linking consumption by purpose to demand for goods and investment by origin to investment by destination. The initial starting point of the model therefore, includes a very detailed treatment of taxation and trade.

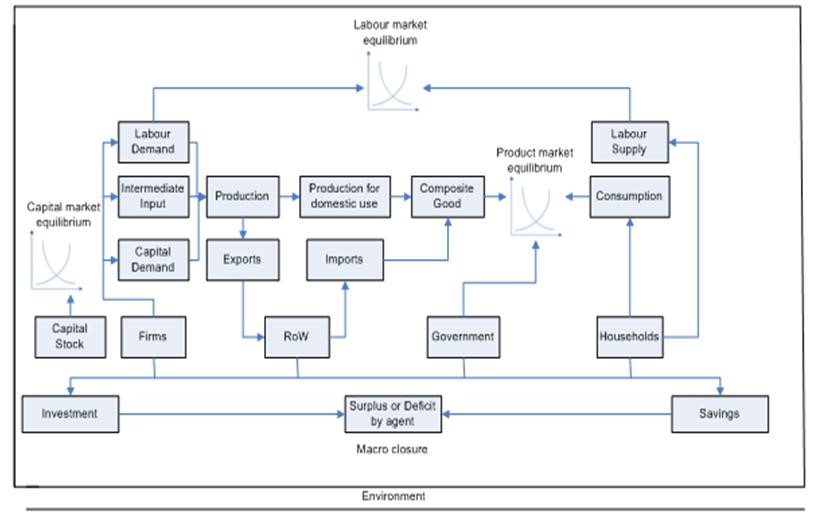

Figure 1: GEM-E3 economic circuit

The GEM-E3 model is built in a modular way around its central CGE core. It supports defining several alternative regimes and closure rules without having to re-specify or re-calibrate the model. The most important of these options are presented below:

• Capital mobility across sectors and/or countries

• Flexible or fixed current account (with respect to the foreign sector)

• Flexible or fixed labour supply

• Market for pollution permits national/international, environmental constraints

• Fixed or flexible public deficit

• Perfect competition or Nash-Cournot competition assumptions for market competition regimes.

Reference scenario and counterfactual simulations

Once the model is calibrated, the next step is to define a reference case scenario. The reference case scenario includes all already decided policies. The key drivers of economic growth in the model are labour force, total factor productivity and the expectations on sectoral growth.

The “counterfactual” equilibria can be computed by running the model under assumptions that diverge from those of the reference scenario. This corresponds to scenario building. In this case, a scenario is defined as a set of changes of exogenous variables, for example a change in the tax rates. Changes of institutional regimes, that are expected to occur in the future, may be reflected by changing values of the appropriate elasticities and other model parameters that allow structural shifts (e.g. market regime). These changes are imposed on top of the assumptions of the reference scenario thereby modifying it.

To perform a counterfactual simulation it is not necessary to re-calibrate the model. The different steps for performing a counterfactual simulation in GEM-E3 are depicted in the figure below.

Figure 2: Steps for scenario simulation in GEM-E3

A counterfactual simulation is characterized by its impact on consumer’s welfare or through the equivalent variation of his welfare function. The approach adopted in most of the applied general equilibrium models regards the use of the monetary utility function, which measures the nominal income that the consumer needs for a given price vector in order to be at the same welfare level with a different income level and a price vector. With this measure it is possible to quantify the effects on welfare of alternative policy scenarios. This measure shows the income that should be given to/taken off the consumer so as to be found at the same welfare level found with the reference scenario prices. A positive value of this measure means a positive change in consumer welfare. The equivalent variation can be, under reasonable assumptions, directly mapped to some of the endogenous variables of the model such as consumption, employment and price levels.

The most important results, provided by GEM-E3, are as follows:

• Dynamic annual projections in volume, value and deflators of national accounts by country

• Full Input-Output tables for each country/region identified in the model

• Distribution of income and transfers in the form of a social accounting matrix by country

• Employment, capital, investment by country and sector

• Greenhouse gasses, atmospheric emissions, pollution abatement capital, purchase of pollution permits and damages

• Consumption matrix by product and investment matrix by ownership branch

• Public finance, tax incidence and revenues by country

• Full bilateral trade matrices.

Solution algorithm

The model is formulated as a simultaneous system of equations with an equal number of variables. The system is solved for each year following a time-forward path. The model uses the GAMS software and is written as a mixed non-linear complementarity problem solved by using the PATH algorithm using the standard solver options.

The model is modularly built allowing the user to select among a number of alternative closure options and market institutional regimes depending on the issue under study.

History of GEM-E3

The GEM-E3 model is the result of a collaborative effort by the National Technical University of Athens (NTUA/E3M-Lab, leading partner), Katholieke Universiteit of Leuven (KUL), University of Manheim and the centre for European Economic Research (ZEW), Ecole Centrale de Paris (ERASME) as the core modelling team. NTUA/E3M-Lab have maintained and further developed the GEM-E3 model in various aspects including the introduction of market imperfections, the construction of GEM-E3 world version, bottom-up representation of power generation technologies, equilibrium unemployment, a complete coverage of all GHG, and the introduction of semi-endogenous growth features.

Applications of the model have been carried out for several Directorate Generals of the European Commission (economic affairs, competition, environment, taxation, research) and for national authorities. GEM-E3 is used regularly to provide analytical support to European Commission services, particularly with regards to the economics of climate change.

1.3) Temporal dimension - GEM-E3

GEM-E3 is a recursive dynamic model solved sequentially over time. In GEM-E3 model agents have myopic expectations. Their future planning is based on current prices. It is assumed that investment that takes place in time t increases the production capacity at time t+1. The current version of the GEM-E3 is calibrated to 2011 (base year data). The model runs up to 2050 with 5 year time steps.

1.4) Spatial dimension - GEM-E3

The GEM-E3 model is a multi-regional model representing 38 countries/regions and 31 sectors of production. EU countries are represented individually in the GEM-E3 (Table 1). The countries/regions are linked through endogenous bilateral trade flows. Total demand is allocated between domestic products and imported products, following the Armington specification. In this specification, branches and sectors use a composite commodity which combines domestically produced and imported goods, which are considered as imperfect substitutes (Armington assumption). Each country buys and imports at the prices set by the supplying countries following their export supply behaviour. The buyer of the composite good (domestic) seeks to minimise his total cost and decides the mix of imported and domestic products so that the marginal rate of substitution equals the ratio of domestic to imported product prices. The GEM-E3 model requires detailed bilateral trade matrices for all regions and commodities included in the model. GTAP database provides such matrices together with bilateral duties and transportation costs. For countries that are not identified separately in GTAP the UN Comtrade database is used in order to extract the relevant data.

Table 1: Countries/regions represented in the GEM-E3 model

| Austria | Finland | Malta | Canada |

| Belgium | France | Netherlands | Brazil |

| Bulgaria | United Kingdom | Poland | China |

| Croatia | Greece | Portugal | India |

| Cyprus | Hungary | Slovakia | Oceania |

| Czech Republic | Ireland | Slovenia | Russian Federation |

| Germany | Italy | Sweden | Rest of Annex I |

| Denmark | Lithuania | Romania | Rest of the World |

| Spain | Luxembourg | USA | |

| Estonia | Latvia | Japan |

1.5) Policy - GEM-E3

The GEM-E3 model has been extensively used by several DGs of the European Commission for policy analysis. Indicative works include those of Paroussos and Kouvaritakis (2003), Kouvaritakis et al. (2005) and Kouvaritakis and Paroussos (2006). GEM-E3 has also been used in a series of research projects funded by the European Commission like the MEDPRO and the AMPERE project. GEM-E3 is a general-purpose model that aims at coping with the specific orientation of the policy issues that are actually considered at the level of the European Commission. Policies are analysed as counterfactual dynamic scenarios and are compared against reference model runs. Policies are then evaluated through their impact on sectoral growth, finance, income distribution and global welfare.

The GEM-E3 model intends to cover the general subject of sustainable economic growth, and to support the study of related policy issues. Sustainable economic growth is considered to depend on combined environmental and energy strategies that will ensure stability of economic development. The general issue, to be analysed with GEM-E3, regards the conditions under which economic growth, and its distributional pattern, can be sustained in the presence of environmental constraints or energy shortages and even reinforced by means of an adequate technological and market-oriented policy.

The model intends, in particular, to analyse the global climate change issue a theme that embraces several aspects and interactions within the economy, energy and environment systems. To reduce greenhouse gas emissions it is necessary to achieve substantial gains in energy conservation and in efficiency in electricity generation, as well as to perform important fuel substitutions throughout the energy system, in favour of less carbon intensive energy forms.

Within the context of increasingly competitive markets, new policy issues arise. For example, it is necessary to give priority to market-oriented policy instruments, such as carbon taxes and pollution permits, and to consider market-driven structural changes, in order to maximise effectiveness and alleviate macroeconomic consequences. Re-structuring of economic sectors and re-location of industrial activities may be also induced by climate change policies. This may have further implications on income distribution, employment, public finance and the current account.

The model is designed to support the analysis of distributional effects that are considered in two senses: distribution among countries and distribution among social and economic groups within each country. The former issues involve changes in the allocation of capital, sectoral activity and trade and have implications on public finance and the current account of member states. The assessment of allocation efficiency of policy is often termed “burden sharing analysis”, which refers to the allocation of efforts (for example taxes), over different countries and economic agents. The analysis is important to adequately define and allocate compensating measures aiming at maximizing economic cohesion. Regarding both types of distributional effects, the model can also analyse and compare coordinated versus non coordinated policies in the European Union.

Technical progress and infrastructure can convey factor productivity improvement to overcome the limits towards sustainable development and social welfare. For example, European RTD strategy and the development of pan-European infrastructure are conceived to enable long-term possibilities of economic growth. The model is designed to support analysis of structural features of economic growth related to technology and evaluate the derived economic implications for competitiveness, employment and the environment.

The model puts emphasis on:

• The analysis of market instruments for energy-related environmental policy, such as taxes, subsidies, regulations, emission permits etc., at a degree of detail that is sufficient for national, sectoral and World-wide policy evaluation.

• The assessment of distributional consequences of programmes and policies, including social equity, employment and cohesion for less developed regions.

• The standard need of the European Commission to periodically produce detailed economic, energy and environment policy scenarios.

2) Socio-economic drivers - GEM-E3

The main drivers of growth in the GEM-E3 model are:

- Population growth

- Technical progress

- Capital accumulation.

In the GEM-E3 model total population and active population growth rates are set exogenously. The model computes endogenously unemployment rates for skilled and unskilled labour. Technical progress can be exogenous or endogenous based on learning by doing, learning by research functions. Investment decisions by firms are endogenous and are based on Tobin's q.

2.1) Population - GEM-E3

Population and population growth are exogenous to the GEM-E3 model. Projections on the EU countries up to 2050 have been extracted from the “2015 Ageing report” prepared by the European Commission. For non-EU countries the ILO projections are used.

2.2) Economic activity - GEM-E3

The model captures the inter-relations of all economic agents of the economic system and computes endogenously sectoral production, sectoral value added, GDP and its components, incomes and employment.

3) Macro-economy - GEM-E3

The model represents 38 countries/regions where each of the EU countries is represented separately. The model considers 31 sectors of production including separately each of the power generation sectors. The sectoral aggregation of the model is summarized in the following table.

Table 2: GEM-E3 sectoral aggregation

| 1. Agriculture | 11. Non-metallic minerals | 21. Non-Market services | 30. Coal CCS |

| 2. Coal | 12. Electric goods | Power Technologies | 31. Gas CCS |

| 3. Crude oil | 13. Transport equipment | 22. Coal fired | |

| 4. Oil | 14. Other equipment goods | 23. Oil fired | |

| 5. Gas | 15. Consumer goods | 24. Gas fired | |

| 6. Electricity supply | 16. Construction | 25. Nuclear | |

| 7. Ferrous metals | 17. Transport (Air) | 26. Biomass | |

| 8. Non-ferrous metals | 18. Transport (Water) | 27. Hydroelectric | |

| 9. Chemical products | 19. Transport (Land) | 28. Wind | |

| 10. Paper products | 20. Market services | 29.PV |

The GEM-E3 model provides details on the macro-economy and its interaction with the environment and the energy system. The economy is represented in detail at macro level and also at micro level through detailed representation of agents' behavior. The model incorporates micro-economic mechanisms and institutional features within a consistent macro-economic framework and avoids the representation of behaviour in reduced form.

At micro level the model formulates in detail the supply and demand behaviour of the economic agents (production, consumption, investment, employment, allocation of their financial assets). Demand from the economic agents and the public sector form total domestic demand. Total demand is allocated between domestic and imported products. In this specification, a composite commodity which combines domestically produced and imported goods (imperfect substitutes) is used. Each country buys and imports at the prices set by the supplying countries.

Firms respond to market demand and formulate demand for intermediate inputs and factors of production (labour, capital, resources). They supply their goods and select a production technology so as to maximize their profit within the current year. The firms can change their stock of capital by undertaking investments. Supply and demand mechanisms determine equilibrium prices. In this process the GEM-E3 model takes fully into account macro level interactions and simultaneously includes all interrelated markets. The model formulates separately the supply or demand behaviour of the economic agents which are considered to optimize individually their objective while market derived prices guarantee global equilibrium, allowing the consistent evaluation of distributional effects of policies.

Model prices are the result of market equilibrium (demand and supply effects). On derived prices appropriate taxation is applied, to form prices as perceived by consumers. The main leading price is that of the composite good. Depending on the destination of a commodity, differentiated taxation may be applied, as for example indirect taxation or VAT.

The equilibrium of the real part is achieved simultaneously in the goods market and in the labour market. In the goods market a distinction is made between tradable and non tradable goods. For the tradable goods the equilibrium condition refers to the equality between the supply of the composite good, related to the Armington equation, and the domestic demand for the composite good. This equilibrium combined with the sales identity, guarantees that total resource and total use in value for each good are identical. For the non tradable, there is no Armington assumption and the good is homogeneous. The equilibrium condition serves then to determine domestic production.

The model is modularly built allowing the user to select among a number of alternative closure options and market institutional regimes depending on the issue under study. The GEM-E3 model includes projections of: full Input-Output tables by country/region, national accounts, employment, balance of payments, public finance and revenues, household consumption, energy use and supply, GHG emissions and atmospheric pollutants. The model considers the appropriate level with respect to geography, the sub-system (energy, environment, economy) and the dynamic mechanisms of agent's behaviour.

Investments

GEM-E3 is a recursive dynamic model (solved sequential over time). The sequential equilibria are linked through a motion equation regarding the update of the capital stock. According to the standard neoclassical approach agents investment decision depends on the rental cost of capital in the presence of adjustment costs and on its replacement cost. In GEM-E3 agents have myopic expectations. Their future planning is based on current prices. The basic methodological approaches to investment specification include the accelerator model and q of Tobin (1969).

Figure 3: Investment decisions of firms

Investment covers the change in firm's potential plus the capital depreciation. Using the average Tobin's q according to Hayashi (1982) the firm decides the optimal level of investment according to the rental price of capital and its replacement cost. It is also assumed that the firms always replace the depreciated capital.

The investment function takes into account: i) adjustment/installment investment costs, ii) flexibility to replace capital, iii) speed of adjustment, iv) exogenous firm's expectations on future profitability and v) productivity of capital. Investment increases the production potentials of the firm from the following period. The unit cost of capital results as the dual price of the equilibrium function of the available and the demanded capital stock.

Firm's investment is translated into demand for investment goods which are produced from the rest of the sectors of the economy through an investment matrix of constant coefficients. The investment demand of each branch is transformed into a demand by product, through fixed technical coefficients, derived from an investment matrix by product and ownership branch. The investment matrix is computed using the intermediate goods used in the production of capital goods and data provided in the literature on the inputs delivered by the sectors of the economy to the investments undertaken by each sector of production.

The standard approach when no additional data are available, is to use the same coefficient structure for each branch. This approach can be extended when additional information is available on investment by branch and on the structure of capital formation. In order to make changes in the investment matrix a simple procedure is followed. The initial investment matrix (with the same coefficients in each branch) is updated with the new investment shares. Then a RAS procedure is followed in order to ensure that the total of each row and column of the investment matrix remains constant and that the model remains balanced.

Public investment, assumed exogenous in the model, is performed by the branch of non-market services. Transfers to the households are computed as an exogenous rate per head times the population. On the receipt side, the model distinguishes between 9 categories of receipts namely: i) indirect taxes, ii) environmental taxes, iii) direct taxes, iv) value added taxes, v) production subsidies, vi) social security contributions, vii) import duties, viii) foreign transfers and viiii) government firms. These receipts are coming from product sales (i.e. from branches) and from sectors (i.e. agents). The receipts from product sales in value, which include indirect taxes, the VAT, subsidies and duties, are computed from the corresponding receipts in value, given the tax base and the tax rate. The receipts from agents are computed from the tax base and the tax rate (social security contributions, direct taxation), share of government in total capital income (for government firm's income) or exogenous (transfers from and to the ROW).

Transfers

The model allows for a free variation of the balance of payments, while the real interest rate is kept fixed. An alternative approach, implemented in the GEM-E3 model as an option, is to set the current account of a country or of the total EU with the rest of the World to a pre-specified value, in fact a time-series set of values, expressed as percentage of GDP. This value is obtained either as a result from the baseline scenario or is given by the modeller as a share of GDP. As a shadow price of this constraint, a shift of the real interest rate at the level of the EU is endogenously computed. This shift is proportionally applied to the real interest rates of each member-state.

The only direct transfers and value flows between branches and sectors in the model, refer to government revenue/expenditures through taxes/subsidies and world revenue/expenditures through imports/exports. Flows considered as revenues of branches (in fact product demand) coming from sectors are detailed in: final consumption of products by sector in value, which includes exports, investment by product and sector in value and stock variation in value.

The transfers between sectors include income flows as described in the SAM. These transfers formulate the disposable income of the households. The most important of these transfers include:

- The dividends the firms pay to the households, which is proportional to the net revenues of the firms

- The social benefits that the government pays to the households, which depends on the number of employees by branch and the rate of government payments to the unemployed

- The direct taxes on the firms which is again proportional to the net revenues of the firms (now excluding dividends) and the households, where the tax is proportional to their disposable income

- The payments of individuals to the government for social security.

The transfers between factors of production and the economic sectors are given in the SAM. The most important of these transfers include:

- Revenues of sectors coming from factors , e.g. labour income of households. Flows considered as revenues of factors coming from branches represent the value added, in value

- Flows from factors to factors and from factors to branches are equal to zero

- Factor payments to sectors are coming from value added and distributed according to an exogenous structure.

The savings of each sector, which if summed up on all economic sectors are equal to total investments, are computed as the difference between revenues which consists of the receipts from the branches plus income from factors and sectors) and expenditures (which include final consumption and transfers to factors and sectors. The surplus/deficit of each sector, which is evaluated by subtracting investment and stock variation from gross savings, ensures that total sector savings equal total sector investments (this equality does not hold on a sector level).

3.1) Production system and representation of economic sectors - GEM-E3

The demand of products by the consumers, the producers (for intermediate consumption and investment) and the public sector constitutes the total domestic demand. This total demand is allocated between domestic products and imported products, following the Armington specification. In this specification, branches and sectors use a composite commodity which combines domestically produced and imported goods, which are considered as imperfect substitutes (Armington assumption).

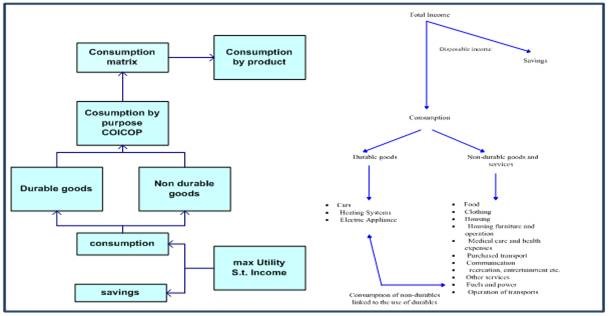

Household demand is determined by the decision to allocate income between current and future consumption (this decision derives from the utility maximization subject to an inter-temporal budget constraint which states that all available disposable income will be spend at the present or at some time in the future) and by the allocation of current expenditure among different consumption categories. Consumption categories include non-durable consumption categories (food, culture etc.) and services from durable goods (cars, heating systems and electric appliances). Based on myopic assumptions about the future, the household decides the amount of leisure that wishes to forsake in order to acquire the desired amount of income (thus also defining labour supply behaviour).

At the second stage, total household consumption is disaggregated into demand for specific consumption goods. For this the integrated model of consumer demand for non-durables and durables, developed by Conrad and Schröder (1991) is implemented. Households obtain utility from consuming a non-durable good or service and from using a durable good. The consumer decide on the desired stock of the durable based not on its relative purchase cost and on the cost of goods linked with that durable.

With regards to the firms, in GEM-E3 production technologies are formulated in an endogenous manner allowing for price-driven demand for intermediate goods. Factor demand is derived from Shephard’s lemma. In this process it is assumed that the stocks of capital and labour are proportional to the optimal flows in volume. At each level of the nesting scheme of the production function, demand for a factor at a lower level of the nesting scheme is linked to bundle to which it belongs, with different substitution elasticities at each level. This gives finally a cost-minimising demand for each production factor.

Behavioural change

GEM-E3 model combines micro and macro analysis. At micro level the model contains a detailed representation of economic agents’ (firms, households, public sector) behavior. The model formulates the supply and demand behaviour of the economic agents regarding production, consumption, investment, employment and allocation of their financial assets. The demand of products by the consumers, the producers (for intermediate consumption and investment) and the public sector constitutes the total domestic demand. This total demand is allocated between domestic products and imported products, following the Armington specification. In this specification, branches and sectors use a composite commodity which combines domestically produced and imported goods, which are considered as imperfect substitutes (Armington assumption). Each country buys and imports at the prices set by the supplying countries following their export supply behaviour. The buyer of the composite good (domestic) seeks to minimise his total cost and decides the mix of imported and domestic products so that the marginal rate of substitution equals the ratio of domestic to imported product prices.

In the GEM-E3 model prices are the result of market equilibrium (demand and supply effects). On derived prices appropriate taxation is applied, to form prices as perceived by consumers. The main leading price is that of the composite good. Depending on the destination of a commodity, differentiated taxation may be applied, as for example indirect taxation or VAT.

Households' behavior

Households in the GEM-E3 SAM are identified as a single social group (a single representative household is modeled). Households maximize their inter-temporal utility under an inter-temporal budget constraint. The demand functions are derived by solving the maximization problem, under general assumptions regarding expectations and steady state conditions. These demand functions allocate the expected income of the household, depending on the formulation of the problem, between consumption goods and future consumption (savings). This is the default formulation of households’ behaviour. Alternatively household behavior is modeled so that the consumer allocates its expected income between present, future consumption and leisure. Households receive income from their ownership of production factors, from other institutions and transfers from the rest of the world. Household expenditure is allocated between consumption, tax payment and savings.

The representative household firstly decides on the allocation of its income between present and future consumption of goods. At a 2nd stage the household allocates its total consumption expenditure between the different consumption categories available. The consumption categories are split in non-durable consumption categories (food, culture etc.) and services from durable goods (cars, heating systems and electric appliances). For this allocation an integrated model of consumer demand for non-durables and durables, developed by Conrad and Schröder (1991) is implemented. The rationale behind the distinction between durables and non-durables is that the households obtain utility from consuming a non-durable good or service and from using a durable good. So for the latter the consumer has to decide on the desired stock of the durable based not only on the relative purchase cost of the durable, but also on the cost of those goods that are needed in connection with the durable (as for example fuels for cars or for heating systems). The general form that is described above is being depicted with a nesting scheme as it is appeared below.

Figure 4: The consumption structure of the GEM-E3 model

Firms' behavior

In the GEM-E3 model firms are modeled to maximize their profits, constrained by the physical capital stock (fixed within the current period) and the available technology. Producers can change their physical capital stock over time through investment. Capital stock data by sector of production are not available either from GTAP or from EUROSTAT databases (it is computed in the calibration phase of the model).

Each producer (represented by an activity) is assumed to maximize profits, defined as the difference between the revenue earned and the cost of factors and intermediate inputs. Profits are maximized subject to its production technology. Domestic production is defined by branch. It is assumed that each branch produces a single good which is differentiated from any other good in the economy.

Production functions in GEM-E3 exhibit a nested separability scheme, involving capital, skilled and unskilled labour, energy and materials and are based on a CES neo-classical type of production function. The exact nesting scheme of production in GEM-E3 has been selected to match available econometric data on KLEM substitution elasticities and the specific features of each activity. The optimal production behaviour can be represented in the primal or the dual formulation. Their equivalence, under certain assumptions, can be verified by the theory of production behaviour.

In the model the dual formulation is used and the long run unit cost function is of the nested CES type with factor-augmenting technical change, i.e. price diminishing technical change. The firm (at branch level) decides its supply of goods or services given its selling price and the prices of production factors.

The production technology exhibits constant return of scale. The firm supplies its good and selects a production technology so as to maximize its profit within the current year, given the fact that the firm cannot change the stock of productive capital within this period of time. The firm can change its stock of capital the following year, by investing in the current one. Since the stock of capital is fixed within the current year, the supply curve of domestic goods is upwards sloping and exhibits decreasing return to scale.

Non-energy sectors: At the 1st level, production is split into two aggregates, one consisting of capital, labour and energy bundle (KLE) and the other consisting of materials (MA). At the 2nd level, (KLE) is split in two aggregates, one consisting of capital and labour bundle (KL), and the other consisting of energy (ENG). (MA) is further divided in its component parts (e.g. Agriculture, Industrial activities, Services etc.). At the 3rd level (KL) is split into capital and skilled labour bundle (KL_skld), which is further decomposed at the 4th level between Capital and skilled Labour and unskilled labour (_L_unskld_), whereas (ENG) is split in electricity and fuels (EN).

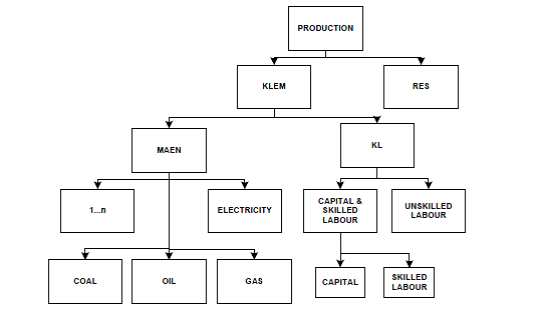

Figure 5: Production nesting scheme in the GEM-E3 model - Non energy sectors

Resource sectors: For the sectors whose production is based on natural resources, at the 1st nesting level production is split between fossil fuel resources (RES) and an aggregate bundle consisting of capital, labour and material-energy (KLEMrs). The latter at the 2nd stage is disaggregated in the material-energy bundle (MAENrs) and the capital-labour bundle (KL). At the 3rd level the capital-labour bundle (KL) is split in capital and skilled labour (KL_skld) and in unskilled labour. The material-energy bundle (MAENrs) is divided into its component parts. Finally capital-skilled labour bundle is spit into capital and skilled labour.

Figure 6: Production nesting scheme in the GEM-E3 model - Resource sectors

Power supply sectors: At the 1st nesting level of the power supply sector, production is split into two aggregates, one consisting of a bundle of power producing technologies (TECH) and the other of the transmission and distribution part (DIST). At the 2nd level, all power producing technologies identified in the model are in the same nest whereas the (DIST) bundle is disaggregated to capital, skilled and unskilled labour and materials.

Figure 7: Production nesting scheme in the GEM-E3 model - Electricity supply

Power producing technologies: one level production function that includes capital, skilled and unskilled labour and fuels is assumed.

Figure 8: Production nesting scheme in the GEM-E3 model - Power producing technologies

Refineries: the nesting structure is similar to the non-energy sectors with a change in the top level of the nest where the two aggregates are now (KLEM) and fuels (FUEL).

Figure 9: Production nesting scheme in the GEM-E3 model - Refineries

Firms address their products to three market segments namely to the domestic market, to the other EU countries and to the rest of the world. Prices are derived through demand/supply interactions. In any iteration of the model run and before global equilibrium is achieved, producers face demand for their products. To this demand they respond with a price. For the PC sectors, since these operate under constant returns to scale and the number of firms is very large, this price depends only on their marginal cost of production.

The producer is assumed not to differentiate his price according to the market to which he sells his products. He therefore sells his products at the same price (equal to his marginal cost reduced by the amount of production subsidies that he receives).

Government behavior

The Governments’ behaviour is exogenous in GEM-E3. Government’s final demand by product is obtained by applying fixed coefficients to the exogenous volume of government consumption.

3.2) Capital and labour markets - GEM-E3

Labour Market

The GEM-E3 model adopts the EUROSTAT definition of the labour force and thus it is computed by multiplying the participation rate to total active population. The databases mainly used to extract these data are the EUROSTAT, ILO and World Bank. The GEM-E3 model has detailed representation of skilled and unskilled labour force by sector of activity, including detailed representation of labour force in the power generation sectors.

The formulation of the labour market adopted in the GEM-E3 assumes the presence of imperfections and rigidities which shift the exogenous labour supply (in the alternative version the utility-derived labour supply), to the left and upwards. Wages drive the balancing of the shifted labour supply with labour demand. Thus involuntary unemployment arises as a result of the distorted labour market equilibrium. The model distinguishes labour between skilled and unskilled labour. Capital and skilled labour substitute each other (except for power generation technologies, where capital and skilled labour complement each other), at the 4th level of production, while capital and skilled labour bundle are substitutes with unskilled labour at the 3rd level of the production. Equilibrium unemployment is modeled for both skilled and unskilled labour.

It is assumed that, due to labour market imperfections and frictions, the employees enjoy a wage premium (a wage rent) on top of the wage rate that would correspond to equilibrium between potential labour supply and labour demand. The wage rate premium leads to a displacement to the left of the potential labour supply curve. The displaced supply curve corresponds to effective labour supply.

In the standard version of the GEM-E3 model labour market is perfect in the sense that wages adjust until there is no excess labour supply and hence unemployment. The model considers the notion of voluntary unemployment through the choice of household for leisure (when the alternative version of labour market is used). In the standard version the representation of involuntary unemployment is based on the efficiency wages approach by Shapiro and Stiglitz (1984).

The wage rate premium is endogenous to the model and is assumed to be the consequence of the existence of Principal-Agent relations: the firms are obliged to pay a wage premium to induce employees not to shirk; as a result effective labour supply is determined through efficiency wages.

The balancing of labour demand with effective, rather than potential, labour supply implies that equilibrium unemployment is determined as the difference between potential and effective labour. This is illustrated in the Figure below which shows unemployment U as difference between potential equilibrium labour LP and effective labour equilibrium LS, corresponding to wage rate w* which includes the wage rent reflecting market imperfections.

Figure 10: Illustration of equilibrium unemployment

An approach for simulating involuntary unemployment relates to the assumption that there is a negative correlation between wages and unemployment. This approach is consistent with the efficiency wages theory of Shapiro & Stiglitz (1984) which states that productivity/quality of labour has a positive correlation with wages. In periods with high unemployment firms are not motivated to offer high wages to attract higher quality labour or to increase productivity of existing workers. On the other hand, at low unemployment rates it is efficient for firms to offer wages above their equilibrium level, because they seek for increases in labour productivity and for reducing the probability of someone quitting the job and hence reducing costs from the recruitment of new personnel. In the GEM-E3 model the efficiency wage approach was finally selected to be the default option for representing involuntary (equilibrium) unemployment. This modelling approach was preferred because of its empirical validation, by using for example Blanchflower and Oswald (1994), its simplicity, and the fact that it is parsimonious in parameters.The specification of efficiency wages in GEM-E3 is based on Shapiro & Stiglitz and Annabi (2003) approaches. The procedure is identical both for skilled and unskilled labour. Efficiency wage is an increasing function of quit rate, the probability of finding a job, the interest rate and the unemployment benefit. In equilibrium the number of workers that are unemployed should equal the number of workers that fill a vacancy.

The implementation of involuntary unemployment in the GEM-E3 model requires additional data (i.e. unemployment levels, minimum wages etc.) that are extracted mainly from the CESifoDICE and EUROSTAT databases.

Capital Market

Three alternative choices for the capital mobility are assumed in the model:

i) Capital is immobile between sectors and between regions.

ii) Mobility across sectors but not across regions.

iii) Full mobility across sectors and regions.

3.3) Monetary instruments - GEM-E3

The model allows for a free variation of the balance of payments, while the real interest rate is kept fixed. An alternative approach, implemented in the GEM-E3 model as an option, is to set the current account of a country or of the total EU with the rest of the world (RoW) to a pre-specified value, in fact a time-series set of values, expressed as percentage of GDP. This value is obtained either as a result from the baseline scenario or is given by the modeller as a share of GDP through the parameter $share\_ca_{er,t}$. As a shadow price of this constraint, a shift of the real interest rate at the level of the EU is endogenously computed. This shift is proportionally applied to the real interest rates of each member-state.

This mechanism enables a robust comparison between scenarios since the modeler does not allow for additional borrowing/lending (in GEME-E3 borrowing/lending is in real terms the balance of trade) of the country due to scenario policies but instead allows for an endogenous change of the real interest rate of the country/region. For example, in a climate policy scenario with a fixed current account as a share of GDP (fixed in baseline levels), the country/region under constraint cannot increase its imports as a reaction to increased unit cost of energy and thereby sustain levels of consumption and welfare but instead has to face an increased real interest rate.

The option of a constant current account as a percentage of GDP is activated in the model by a switch parameter.

3.4) Trade - GEM-E3

Total domestic demand consists of the demand of products by the consumers, the producers (for intermediate consumption and investment) and the public sector. This is allocated between domestic products and imported products, according to the Armington specification. Each country buys and imports at the prices set by the supplying countries following their export supply behaviour.

Figure 11: Trade matrix for EU and the rest of the world

GEM-E3 employs a nested commodity aggregation hierarchy, in which branch’s i total demand is modelled as demand for a composite good or quantity index Yi which is defined over demand for the domestically produced variant and the aggregate import good. At a next level, demand for imports is allocated across imported goods by country of origin. Bilateral trade flows are thus treated endogenously in GEM-E3.

Figure 12: Domestic demand and trade flows nesting scheme

The minimum unit cost of the composite good determines its selling price. This is formulated through a CET unit cost function, involving the selling price of the domestic good, which is determined by goods market equilibrium, and the price of imported goods, which is taken from the 2nd level Armington. By applying Shephard’s lemma, total demand for domestically produced goods and for imported goods is derived.

Export of services from country cr to country cs will be equal to the bilateral import of services of country cs from cr. The model ensures analytically that, the balance of trade matrix in value and the global Walras law is verified in all cases. A trade flow from one country to another country matches, by construction, the inverse flow. The model ensures this symmetry in volume, value and deflator. Thus the model guarantees (in any scenario run) all balance conditions applied to the world trade matrix, as well as the Walras law at the level of the planet.

3.5) Technological change - GEM-E3

Technical progress is explicitly represented in the GEM-E3 in the production function, either exogenously or endogenously, depending on the R&D expenditure by private and public sector and taking into account spillovers effects. Technological progress is based on the myopic expectations of the participant agents. The production technology exhibits constant returns to scale. Firms supply their goods and select a production technology so as to maximise their profit within the current year, given the fact that they cannot change the stock of productive capital within this period of time. The stock of capital is fixed within the current year. Firms can change their stock of capital the following year, by investing in the current one.

4) Energy - GEM-E3

4.1) Energy resource endowments - GEM-E3

GEM-E3 considers only energy related depletable resources. Coal, oil and gas sectors are associated with the respective reserves. For the depletable resource sectors reserves are considered to be a discrete production factor. The international price of the fossil fuel is calculated so as to balance total supply and total demand of reserves.

4.2) Energy conversion - GEM-E3

Table 3: Alternative power generation technologies

| Coal | Oil | Gas | Coal w/ CCS | Oil w/ CCS | Gas w/ CCS | Biomass | Bio w/ CCS | Non-Biomass renewables | Nuclear | Other | |

| Electricity | x | x | x | x | □ | x | x | □ | x | x | □ |

| Liquids | □ | □ | □ | □ | □ | □ | □ | □ | □ | □ | □ |

| Gases | □ | □ | □ | □ | □ | □ | □ | □ | □ | □ | □ |

| Solids | □ | □ | □ | □ | □ | □ | □ | □ | □ | □ | □ |

| Heat | □ | □ | □ | □ | □ | □ | □ | □ | □ | □ | □ |

| Hydrogen | □ | □ | □ | □ | □ | □ | □ | □ | □ | □ | □ |

| Other | □ | □ | □ | □ | □ | □ | □ | □ | □ | □ | □ |

Alternative power generation technologies (conventional: coal, oil, gas and RES: hydro, biomass, solar, wind, coal and gas CCS and nuclear) are represented separately in the GEM-E3. “Electricity” sector represents power transmission and distribution. For the depletable resource sectors (coal, oil, gas) reserves are considered to be a discrete production factor. The international price of the fossil fuel is calculated so as to balance total supply and total demand.

Energy and fuels enter at different levels of the nesting scheme of the production function, always linking the demand for them at a lower level of the nesting scheme to the bundle to which they belong, with different substitution elasticities at each level. This gives finally a cost-minimising demand for energy and fuels. For the non-energy sectors energy is split at the 4th level of production between electricity and fuels. For the sectors whose production is based on natural resources, production is split at the 1st nesting level between fossil fuel resources and an aggregate bundle consisting of capital, labour and material-energy. The latter at the 2nd stage is disaggregated into the material-energy bundle. At the 3rd level the material-energy bundle is divided into its component parts. Production of power supply sectors is split at the 1st level of the power supply sector into the bundle of power producing technologies and the transmission and distribution part. At the 2nd level, all power producing technologies identified in the model are in the same nest. Transmission and distribution bundle is disaggregated to capital, skilled and unskilled labour and materials. For the power producing technologies one level of production function (including capital, labour and fuels) is considered.

4.2.1) Electricity - GEM-E3

CGE models have been criticized for their simplified modelling approach of the energy system. The usual CGE representation of the energy production by means of aggregate production functions fails to capture crucial characteristics of the sector reducing the credibility of simulations related to energy policies and technology dynamics. The bottom up models employed instead, ignore the feedbacks from the interaction of the energy sector with the wider economy within which it operates.

The development of a modelling framework that encompasses the multi market equilibrium of top down models with an engineering consistent representation of power producing technologies constitutes a long-standing challenge in applied energy policy analysis. Many different approaches have been employed to link bottom up and top down models and can be classified in two main categories:

• Hard link approach, that is, integrating both bottom-up and top-down features in a consistent modelling framework. Such an integrated framework is provided by the specification of market equilibrium models as mixed complementarity problems.

• Soft-link or decomposition approach where bottom-up and top-down models are run independently of each other. In this case results from one model are fed into the other, and vice versa.

A characteristic example of the first category is found in Boehringer (1998) where the electricity generating technologies are modeled as specific activities within a mathematical-programming representation of the electricity sector, which is embedded directly in a computable general equilibrium model. In particular his approach is based on the complementarity formulation of the general equilibrium problem while the representation of the electricity producing sectors is based on Koopmans (1951) activity analysis framework. The standard aggregate production functions (C.E.S. or CD) used in the model are replaced by a set of discrete Leontief technologies (fixed input/output vector).

Towards the same direction lies McFarland et al. (2004), who suggest a more flexible format through a C.E.S. representation of energy technologies. Their approach consists of splitting the energy sector using engineering bottom up data and then calibrate the model’s smooth production functions on these data. In particular in their approach the cost estimates on capital, labour, and fuel inputs are used directly as the CES share parameters. The nesting scheme of the production function allows for the appropriate input substitution while the control of technology penetration rate is based on an endogenous quasi fixed factor coefficient introduced at the top level of the C.E.S. production function. Each technology produces electricity through a C.E.S. aggregation of its primary and secondary inputs (low elasticities of substitution chosen at this nesting level), while total electricity production results from a CES aggregation of all power technologies represented in the model (high elasticities of substitution at this nesting level).

A disadvantage of this approach lies in its treatment of investment decisions. That is, investment is either allocated to electricity technologies exogenously or decided at the level of the aggregate electricity sector and then allocated to each technology using a logit function. This investment formulation although it allows for multiple technologies with different costs to coexist is not sufficient to represent the investment behavior of the electricity sector (i.e. each sector should decide the level of investment as a function of its profit function and then this investment demand should be translated to demand for investment products produced by other sectors). In addition the non-smooth (kinked) representation of power supply results in sharp shifts in the technology mix of electricity production implying unrealistic swift switching between technologies.

The second category refers mainly to a decomposition method that links bottom up models with top down by combining different mathematical formats - mixed complementarity and mathematical programming. In Boehringer & Rutherford (2008) mixed complementarity methods (MCP) are used to solve the top-down economic equilibrium model and quadratic programming (QP) to solve the underlying bottom-up energy supply model. Then they reconcile equilibrium prices and quantities between both models through an iterative procedure portray this iterative solution process).

Hybrid Bottom Up Top Down (BUTD*)* CGE models are still rare in the policy modelling literature due to difficulties arising from the integration of macroeconomic and engineering data in a consistent way. E3M-Lab has designed and incorporated into the GEM-E3 model a bottom up top down module. The motivation for this development was the need for a better representation of the electricity sector investment decision. Toward this end, electricity producing technologies were treated as separate production sectors while their investment decision is discrete. The advantage of this approach is that it is fully consistent with the general equilibrium framework while it leads to a full identification of the technologies.

The Input-Output tables represent the electricity sector as an aggregate of two activities, the power generation and the transmission and distribution of electricity. This detail is not sufficient for the development of the bottom up model, so it has been necessary to split the Input-Output column and row in different activities, some corresponding to power generation by technology and the rest corresponding to transmission and distribution of electricity. The split was performed by combining data from energy balances and company- related economic data on generation and transmission and distribution activities by country. The aggregate data were based on Eurostat, IEA and USA DOE statistics. For example, the disaggregation shows that the generation cost accounts for over half of total cost and in most E.U. countries they account for over 60% while transmission costs range between 5% and 10%.

In order to disaggregate the power sector appropriate mapping has been specified between the entries of the Input-Output table and the engineering information retrieved from the technical databases. For this purpose data on capital cost, fixed operating and maintenance cost, fuel cost and other variable operating and maintenance costs, related to the energy producing technologies to be incorporated in the model following cost elements have been extracted from the engineering database.

The unit costs have been associated with the corresponding cost elements of the Input-Output statistics, according to the following principles: i) annualised capital costs correspond broadly to operating surpluses, ii) fuel costs correspond to the fuel input, iii) fixed operating and maintenance cost correspond to non-energy inputs (materials), iv) variable operating and maintenance costs are associated with wages and salaries paid to employees in power generation. Since the entire GEM-E3 model is calibrated on the social accounting matrices the macroeconomic data have been kept constant and the market and cost shares of the technologies have been appropriately adjusted. The purpose of the calibration has been to depart as little as possible from the flows suggested by the engineering information while respecting exactly the totals appearing in the original input output table. For this purpose a cross entropy method has been applied.

The model represents separately 10 conventional and RES power generation technologies. The technologies incorporated in the GEM-E3 model are presented in the following table.

Table 4: Electricity producing technologies represented in GEM-E3 model

| No | Description | No | Description |

| 1 | Coal fired | 6 | Hydro electric |

| 2 | Oil fired | 7 | Wind |

| 3 | Gas fired | 8 | CSP and Photovoltaics |

| 4 | Nuclear | 9 | Coal CCS |

| 5 | Biomass | 10 | Gas CCS |

Generation costs are conceived in three categories: i) investment costs, ii) operating and maintenance costs and iii) fuel costs. Unit cost data and projections to the future for the first two categories are extracted from the TECHPOL and PRIMES database. The fuel costs depend on other variables of the GEM-E3. The data for each technology as introduced in the model are presented in the following table.

Table 5: Electricity production cost shares

| Coal fired | Oil fired | Gas fired | Nuclear | Biomass | Hydro electric | Wind | PV | |

| Agriculture | 25.0 | |||||||

| Coal | 24.3 | |||||||

| Oil | 70.6 | |||||||

| Gas | 73.2 | |||||||

| Chemicals | 6.7 | |||||||

| Other equipment goods | 5.0 | 0.5 | 0.5 | 0.5 | 1.5 | 1.0 | 9.8 | 0.8 |

| Construction | 3.0 | 2.0 | 4.7 | 1.0 | 1.5 | 3.0 | 5.8 | 6.7 |

| Capital | 56.6 | 22.3 | 19.3 | 87.6 | 67.4 | 80.3 | 8.0 | 83.2 |

| Labour | 11.1 | 4.7 | 2.2 | 4.2 | 4.6 | 15.7 | 4.4 | 9.2 |

| Total | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

Source: Calculations based on TECHPOL and PRIMES databases

The shares of each technology in power generation in the base year are introduced from energy balance statistics. Some of the potential technologies that may develop in the future are not used in the base year. Since the production function for power generation is calibrated to the base year, it is necessary to introduce artificially small shares even for the non existing technologies in order to allow for the possibility of their penetration in the future under market conditions.

The development of the database on technology market shares and share of transmission and distribution cost to total cost of electricity production has been based on the TECHPOL database, the ENERDATA database and the PRIMES model database.

4.2.6) Grid, pipelines and other infrastructure - GEM-E3

In the GEM-E3 model the transmission and distribution of electricity are represented at aggregate level. "Electricity" sector accounts for transmission and distribution. Data from Eurostat, IEA and USA DOE have been employed so as to calculate the transmission and distribution costs by technology.

4.3) Energy end-use - GEM-E3

The Input Output representation of all economic activities allows to capture the energy transactions made by each intermediate and final consumer.

4.3.1) Transport - GEM-E3

The GEM-E3 transport module is designed to analyze how the transformation of the transport sector affects the economy through multiple channels either directly (investment in infrastructure, the purchasing of vehicles and fuels of new technology, the cost of acquiring transport services, etc.) or/and indirectly (changes in activity of all sectors, foreign trade, consumption and labour and capital markets, including the eventual crowding out effects due to higher cost of mobility compared to business-as-usual). It incorporates a detailed representation of the transport sector, as well as fleet choice and energy consumption. In this respect, sectors and commodities are split according to the transport modes and means utilized in standard transport models. The model distinguishes the technologies for transport means, and endogenizes the choice of technologies in the simulation of investment by sectors providing transport services and the purchasing of durable goods by households. Finally, the operation of the transport means is related to the sectors producing the energy commodities, including alternative fuels, such as electricity and biofuels.

As regards the transport modes, the sectorial split follows and further extends the classification used by the GTAP database. This extension splits the GTAP data in passenger and freight transport by mode and further disaggregates the modes into rail and road as well as distinguishes between public and private transport. This extension is based on several transport databases where data for turnover by transport sector, transport activity, volumes of transported goods in international trade and transport prices and margins for freight transport modes are available. The decomposed data are organised in Input-Output tables, international transport table, the matrix of consumption by purpose and by product and the investment matrix.

The production of biofuels is explicit (following the methodology of GTAP). For the production of the biofuels bio-gasoline and biodiesel production sectors are involved both of which use feedstock from agriculture sectors. Biofuels are further disaggregated according to the feedstock and the methods used for their production. Transport sectors and households consume oil products, gas, biofuels and electricity for transport purposes.

The model distinguishes between the sectors producing conventional vehicles and a sector producing electric vehicles, in order to capture price differentials of car types and the impacts of global competition on car manufacturing. The electric vehicles sector is linked to endogenous learning functions for the possibility of cost reduction, largely due to batteries, as a function of production volume.

The stock of vehicles (transport sector) and the cars (durable goods), changes with respect to time due to mobility and scrappage. Vehicle types – technologies are chosen according to the relative costs (i.e. purchasing cost, running costs and cost factors reflecting uncertainty factors depending on technology maturity and the availability of recharging or refuelling infrastructure). The cost of conventional technologies is penalised when they do not meet the CO2 standards. Taxes, revenues, subsidies and expenditures for public infrastructure are all part of the public budget, which deficits or surpluses influence the economy through their impact in the interest rates. Hence, the model captures the economy-wide effects of the public funding of transport sectors and infrastructure, and the effects of fuel taxation or potential subsidisation of new car technologies.

Modelling demand for transport services by business sectors

At the top two levels of the nested structure, the model represent substitution possibilities between capital, labour, aggregate energy, aggregate transport and aggregate materials (Figure 13). Thus the usual capital-labour-energy-materials (KLEM) substitution scheme has been extended by introducing aggregate transport services (KLEMT). It is further assumed that there are no substitution possibilities between aggregate transport and aggregate materials in production, as such substitution makes no sense in reality.