Trade - REMIND-MAgPIE

| Corresponding documentation | |

|---|---|

| Previous versions | |

| Model information | |

| Model link | |

| Institution | Potsdam Institut für Klimafolgenforschung (PIK), Germany, https://www.pik-potsdam.de. |

| Solution concept | General equilibrium (closed economy)MAgPIE: partial equilibrium model of the agricultural sector; |

| Solution method | OptimizationMAgPIE: cost minimization; |

| Anticipation | |

REMIND-MAgPIE considers the trade of coal, gas, oil, biomass, uranium, the composite good (aggregated output of the macro-economic system), and emissions permits (in the case of climate policy). It assumes that renewable energy sources (other than biomass) and secondary energy carriers are non-tradable across regions. As an exception, REMIND-MAgPIE can consider bilateral trade in electricity between specific region pairs (e.g., Europe and North Africa / Middle East), but this is not part of the default scenario. To be consistent with trade statistics, trade in petroleum products is subsumed under crude oil trade.

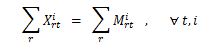

For each good i a global trade balance equation ensures that markets are cleared:

<figure id="fig:REMIND-MAgPIE_3.2.1 3">

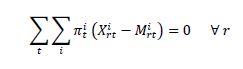

REMIND-MAgPIE models regional trade via a common pool, with the exception of the bilateral electricity trade mentioned above. While each region is an open system - meaning that it can import more than it exports - the global system is closed. The combination of regional budget constraints and international trade balances ensures that the sum of regional consumption, investments, and energy-system expenditures cannot be greater than the global total output in each period. In line with the classical Heckscher-Ohlin and Ricardian models [1], trade between regions is induced by differences in factor endowments and technologies. REMIND-MAgPIE also represents the additional possibility of inter-temporal trade. This can be interpreted as capital trade or borrowing and lending. For each region, the value of exports must balance the value of imports within the time horizon of the model. This is ensured by the inter-temporal budget constraint, where πir is the present value price of good i.

<figure id="fig:REMIND-MAgPIE_3.2.1 4"> File:REMIND-MAgPIE trade 2.JPG </figure>

In this equation discounting is implicit by using present value prices. Inter-temporal trade and the capital mobility implied by trade in the composite good, cause prices of mobile factors to equalize, thus providing the basis for an inter-temporal and inter-regional equilibrium. Since no capital market distortions are considered, the interest rates equalize across regions. Similarly, permit prices equalize across regions, unless their trade is restricted. By contrast, final energy prices and wages can differ across regions because these factors are immobile. Prices for traded primary energy carriers differ according to the transportation costs.

<figure id="fig:REMIND-MAgPIE_3.2.1 5">

Trade balances imply that the regional current accounts (and their counterparts - capital accounts) have a sum of zero at each point in time. In other words, regions with a current account surplus balance regions with a current account deficit. The inter-temporal budget constraints clear debts and assets that accrue through trade over time. This means that an export surplus qualifies the exporting region for an import surplus (of the same present value) in the future, thus also implying a loss of consumption for the current period. REMIND-MAgPIE models trading of emissions permits in a similar way. In the presence of a global carbon market, the initial allocation of emissions rights is determined by a burden-sharing rule wherein permits can be freely traded among world regions. A permit-constraint equation ensures that an emissions certificate covers each unit of GHG emissions. Trade of resources is subject to trade costs. In terms of consumable generic goods, the representative households in REMIND-MAgPIE are indifferent to domestic and foreign goods as well as foreign goods from different origins. This can potentially lead to a strong specialization pattern.

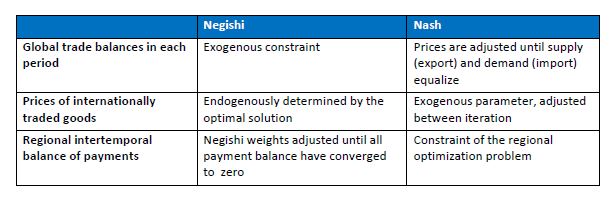

Two solution concepts for the treatment of trade exist, called Nash and Negishi approach. The Negishi approach includes trade balances of all goods explicitly and adjusts the welfare weights in order to guarantee that the intertemporal balance of payments of each region is settled. Prices are derived from the shadow prices of the trade balances in each iteration.

In contrast, the Nash approach adjusts goods prices until demand and supply of traded goods are equalized. There are no explicit market clearning conditions, and regions optimize separately, facing their individual intertemporal balance of payments. In each iteration, the international prices are exogenous parameters for all regions.

In the absence of inter-regional externalities, both solution approaches converge to the same solution.

Table 1. Characterization of the treatment of trade in the two alternative Negishi and Nash solution concepts.

<figtable id="tab:REMIND-MAgPIEtable_2">

- ↑ Heckscher EF, Ohlin B, Flam H, Flanders MJ (1991) Heckscher-Ohlin trade theory. MIT Press, Cambridge, Massachusetts