Uranium and other fissile resources - REMIND-MAgPIE: Difference between revisions

Laura Delsa (talk | contribs) No edit summary |

m (Text replacement - "REMIND" to "REMIND-MAgPIE") |

||

| (31 intermediate revisions by 3 users not shown) | |||

| Line 1: | Line 1: | ||

{{ModelDocumentationTemplate | {{ModelDocumentationTemplate | ||

|IsDocumentationOf=REMIND | |IsEmpty=No | ||

|IsDocumentationOf=REMIND-MAgPIE | |||

|DocumentationCategory=Uranium and other fissile resources | |DocumentationCategory=Uranium and other fissile resources | ||

}} | }} | ||

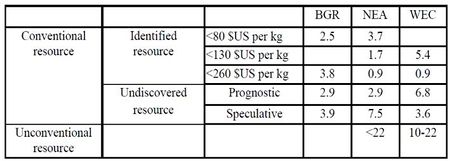

= | A comparison of regularly up-dated assessments of global uranium availability is given in <xr id="fig:REMIND-MAgPIE_1"/>. Conventional identified resources of uranium are differentiated into recovery cost categories. The assessment by the Nuclear Energy Agency <ref>Nuclear Energy Agency NEA (2010): Uranium 2009. Resources, Production, and Demand. Nuclear Energy Agency and Organization of Economic Co-operation and Development. Paris, France.</ref> comprises 6.3Mt of uranium, which equals approximately one hundred times current reactor requirements. The estimates of World Energy Council <ref>World Energy Council WEC (2010): 2010 Survey of energy resources. London, UK.</ref> and German Geological Survey <ref>Bundesanstalt für Geowissenschaften und Rohstoffe BGR (2010): Reserven, Ressourcen und Verfügbarkeit von Energierohstoffen. Hannover, Germany.</ref> mainly rely on the numbers of NEA but apply different interpretations for identified uranium resources. The more uncertain category of conventional undiscovered uranium resources are also assessed differently by the three institutions. | ||

For the default version the assumption is that 23MtUr are ultimately available with increasing extraction costs up to 260$US per tUr. The implementation uses a quadratic extraction cost function for each region that starts at 25US$ per kg uranium and cuts off at the same marginal costs (300$US per kg uranium), if - at the global level - 23MtUr are reached. The shape parameter of the regional extraction cost functions depend on the regional availability of uranium resources. The default version does not represent reprocessing and fast breeding reactors integrated into the nuclear fuel cycle. Given the optimistic assessment of uranium resources this assumption is economically reasonable in the near-term<ref>Bunn M, Holdren JP, Fetter S, van der Zwaan BCC (2005): The economics of reprocessing versus direct disposal of spent nuclear fuel. Nuclear Technology 150:209-30.</ref>. | |||

'''Figure 1'''. Overview of assessments on global uranium in Mt uranium. Identified resources are differentiated by cost categories; undiscovered resources are differentiated by geological certainty. | |||

REMIND | <figure id="fig:REMIND-MAgPIE_1"> | ||

[[File: Table uranium.jpeg.JPG|450px]] | |||

</figure> | |||

<references /> | |||

Latest revision as of 15:34, 21 November 2021

| Corresponding documentation | |

|---|---|

| Previous versions | |

| Model information | |

| Model link | |

| Institution | Potsdam Institut für Klimafolgenforschung (PIK), Germany, https://www.pik-potsdam.de. |

| Solution concept | General equilibrium (closed economy)MAgPIE: partial equilibrium model of the agricultural sector; |

| Solution method | OptimizationMAgPIE: cost minimization; |

| Anticipation | |

A comparison of regularly up-dated assessments of global uranium availability is given in <xr id="fig:REMIND-MAgPIE_1"/>. Conventional identified resources of uranium are differentiated into recovery cost categories. The assessment by the Nuclear Energy Agency [1] comprises 6.3Mt of uranium, which equals approximately one hundred times current reactor requirements. The estimates of World Energy Council [2] and German Geological Survey [3] mainly rely on the numbers of NEA but apply different interpretations for identified uranium resources. The more uncertain category of conventional undiscovered uranium resources are also assessed differently by the three institutions.

For the default version the assumption is that 23MtUr are ultimately available with increasing extraction costs up to 260$US per tUr. The implementation uses a quadratic extraction cost function for each region that starts at 25US$ per kg uranium and cuts off at the same marginal costs (300$US per kg uranium), if - at the global level - 23MtUr are reached. The shape parameter of the regional extraction cost functions depend on the regional availability of uranium resources. The default version does not represent reprocessing and fast breeding reactors integrated into the nuclear fuel cycle. Given the optimistic assessment of uranium resources this assumption is economically reasonable in the near-term[4].

Figure 1. Overview of assessments on global uranium in Mt uranium. Identified resources are differentiated by cost categories; undiscovered resources are differentiated by geological certainty.

<figure id="fig:REMIND-MAgPIE_1">

</figure>

</figure>

- ↑ Nuclear Energy Agency NEA (2010): Uranium 2009. Resources, Production, and Demand. Nuclear Energy Agency and Organization of Economic Co-operation and Development. Paris, France.

- ↑ World Energy Council WEC (2010): 2010 Survey of energy resources. London, UK.

- ↑ Bundesanstalt für Geowissenschaften und Rohstoffe BGR (2010): Reserven, Ressourcen und Verfügbarkeit von Energierohstoffen. Hannover, Germany.

- ↑ Bunn M, Holdren JP, Fetter S, van der Zwaan BCC (2005): The economics of reprocessing versus direct disposal of spent nuclear fuel. Nuclear Technology 150:209-30.