Macro-economy - REMIND-MAgPIE

| Corresponding documentation | |

|---|---|

| Previous versions | |

| Model information | |

| Model link | |

| Institution | Potsdam Institut für Klimafolgenforschung (PIK), Germany, https://www.pik-potsdam.de. |

| Solution concept | General equilibrium (closed economy)MAgPIE: partial equilibrium model of the agricultural sector; |

| Solution method | OptimizationMAgPIE: cost minimization; |

| Anticipation | |

Note: This pages describes the REMIND 1.7 model. It will be updated shortly to describe the most recent version of REMIND-MAgPIE.

Objective function

REMIND-MAgPIE models each region r as a representative household with a utility function Ur that depends upon per-capita consumption

<figure id="fig:REMIND-MAgPIE_3.2.1 1.">

</figure>

where C(r,t) is the consumption of region r at time t, and P(r,t) is the population in region r at time t. The calculation of utility is subject to discounting; 3% is assumed for the pure rate of time preference rho. The logarithmic relationship between per-capita consumption and regional utility implies an elasticity of marginal consumption of 1. Thus, in line with the Keynes-Ramsey rule, REMIND-MAgPIE yields an endogenous interest rate in real terms of 5–6% for an economic growth rate of 2–3%. This is in line with the interest rates typically observed on capital markets.

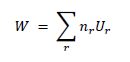

REMIND-MAgPIE can compute maximum regional utility (welfare) by two different solution concepts – the Negishi approach and the Nash approach [1]. In the Negishi approach, which computes a cooperative solution, the objective of the Joint Maximization Problem is the weighted sum of regional utilities, maximized subject to all other constraints:

<figure id="fig:REMIND-MAgPIE_3.2.1 2.">

An iterative algorithm adjusts the weights so as to equalize the intertemporal balance of payments of each region over the entire time horizon. This convergence criterion ensures that the Pareto-optimal solution of the model corresponds with the market equilibrium in the absence of non-internalized externalities. The algorithm is an inter-temporal extension of the original Negishi approach [2]; see also [3] for a discussion of the extension. Other models such as MERGE [4] and RICE50+ [5] use this algorithm in a similar way.

The Nash solution concept, by contrast, arrives at the Pareto solution not by Joint Maximization, but by maximizing the regional welfare subject to regional constraints and international prices that are taken as exogenous data for each region. The intertemporal balance of payments of each region has to equal zero and is one particular constraint imposed on each region. The equilibrium solution is found by iteratively adjusting the international prices until global demand and supply are balanced on each market. The choice of the solution concept is also important for the representation of trade, as discussed in Section the section on Trade.

In contrast to the Negishi approach, which solves for a co-operative Pareto solution, the Nash approach solves for a non-cooperative Pareto solution. The cooperative solution internalizes interregional spillovers between regions by optimizing the global welfare by using Joint Maximization. The non-cooperative solution considers spillovers as well, but they are not internalized. The relevant externalities are the technology learning effects in the energy sector.

- ↑ Leimbach M, Schultes A, Baumstark L, et al (2016) Solution algorithms of large‐scale Integrated Assessment models on climate change. Annals of Operations Research, doi:10.1007/s10479-016-2340-z

- ↑ Negishi T (1972) General equilibrium theory and international trade. North-Holland Publishing Company Amsterdam, London

- ↑ Manne AS, Rutherford TF (1994) International Trade in Oil, Gas and Carbon Emission Rights: An Intertemporal General Equilibrium Model. The Energy Journal Volume15:57–76

- ↑ Manne A, Mendelsohn R, Richels R (1995) MERGE: A model for evaluating regional and global effects of GHG reduction policies. Energy Policy 23:17–34. doi: 10.1016/0301-4215(95)90763-W

- ↑ Nordhaus WD, Yang Z (1996) A Regional Dynamic General-Equilibrium Model of Alternative Climate-Change Strategies. The American Economic Review 86:741–765