Electricity - POLES: Difference between revisions

No edit summary |

No edit summary |

||

| Line 3: | Line 3: | ||

|DocumentationCategory=Electricity | |DocumentationCategory=Electricity | ||

}} | }} | ||

The electricity system consists | |||

The electricity system consists of 3 main parts: | |||

== Demand load curve == | == Demand load curve == | ||

== | POLES considers 2 typical days (winter and summer), each split into 12 time arrays of 2 hours each. The demand load curve is derived from the sum of sectoral electricity demand load curves (end uses), net trade and losses. | ||

These two days are the base of 27 days each, which are the combinations of low, medium and high situations for demand, wind production and solar production. This way, extreme situations are taken into account in the operation and planning of the power system. | |||

== Operation (production and storage) == | |||

The model considers first the non-dispatchable energy sources (hydro, wind, solar). The residual load is met by dispatchable generators based on their variable costs (efficiency and fuel cost, including additional taxes or financial support schemes). A proxy for the power price is computed based on the marginal producer's cost. Storage technologies and demand response (which shift a part of the load to another time slice of a given day) are used if the within-day spread of two-hourly prices compensates their efficiency losses. The number of full load hours of each production and storage technology is the weighted aggregation of these 54 days. | |||

Some over production can appear when the non-dispatchable productions (also taking into account a minimum power output for must-run technologies) exceed demand. When possible it is stored; otherwise it is curtailed and the load factors of wind and solar are decreased accordingly. | |||

== Capacity planning == | |||

The planning of new capacities needs to address expected future electricity needs (based on a rolling ten-year extrapolation) while considering the upcoming decommissioning of existing plants (with vintage) and the special contribution of wind and solar (non-dispatchable). | |||

The | The 648 time-slices per year (54*12) are organised in seven blocks with expected capacity factors of 8760 hours, 8030 hours, 6570 hours, 5110 hours, 3650 hours, 2190 hours and 730 hours. The associated number of full load hours define different total production costs for each of these blocks. This defines the theoretical technology market shares together with coefficients that are calibrated to replicate historical technology mix. | ||

Non-dispatchable wind and solare are first determined, in competition with all technologies. However, they don't produce constantly on all seven blocks. Once their capacity is decided (limited by a maximum potential), the remaining need per investment block is updated with the actual production of wind and solar (which is deduced from the current participation of wind of solar in each block). | |||

The dispatchable technologies are then planned based on the remaining capacity needs for each investment block, the theoretical market shares and the resource constraints for some technologies. | |||

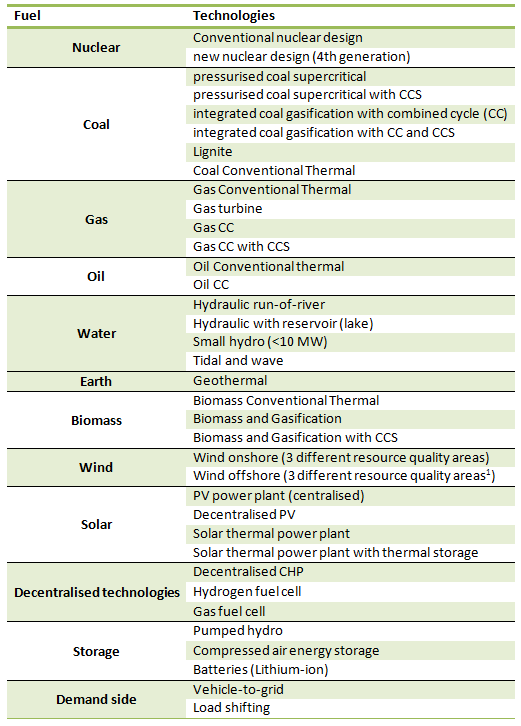

[[File:Power-technologies.png|none|521px|thumb|<caption>Electricity production technologies in POLES</caption>]] | |||

In addition to the technologies mentioned in the figure above, one POLES version includes further detail of biomass technologies in the EU, based on work with the GREEN-X model. | |||

== Electricity prices == | |||

Total production cost is the sum of fixed cost (investment, discount rate, fixed O&M) and variable cost (fuel cost, efficiency, variable O&M), including further taxes or financial support schemes. Investment costs evolve with learning functions (exogenous, endogenous 1 factor, endogenous 2 factors). Efficiency is exogenous. Fuel costs are derived from endogenous fuel prices and assumptions on taxation policies. | |||

Finally the POLES model calculates electricity prices from system production cost for base load (used to set the price for industry) and peak load (used to set the price for residential-services-transport). | Finally the POLES model calculates electricity prices from system production cost for base load (used to set the price for industry) and peak load (used to set the price for residential-services-transport). | ||

Information sources include: Enerdata, Eurostat, IEA, ENTSO-E, ETDB | Information sources include: Enerdata, Eurostat, IEA, ENTSO-E, ETDB | ||

Revision as of 16:24, 20 October 2016

| Corresponding documentation | |

|---|---|

| Previous versions | |

| Model information | |

| Model link | |

| Institution | JRC - Joint Research Centre - European Commission (EC-JRC), Belgium, http://ec.europa.eu/jrc/en/. |

| Solution concept | Partial equilibrium (price elastic demand) |

| Solution method | SimulationRecursive simulation |

| Anticipation | Myopic |

The electricity system consists of 3 main parts:

Demand load curve

POLES considers 2 typical days (winter and summer), each split into 12 time arrays of 2 hours each. The demand load curve is derived from the sum of sectoral electricity demand load curves (end uses), net trade and losses. These two days are the base of 27 days each, which are the combinations of low, medium and high situations for demand, wind production and solar production. This way, extreme situations are taken into account in the operation and planning of the power system.

Operation (production and storage)

The model considers first the non-dispatchable energy sources (hydro, wind, solar). The residual load is met by dispatchable generators based on their variable costs (efficiency and fuel cost, including additional taxes or financial support schemes). A proxy for the power price is computed based on the marginal producer's cost. Storage technologies and demand response (which shift a part of the load to another time slice of a given day) are used if the within-day spread of two-hourly prices compensates their efficiency losses. The number of full load hours of each production and storage technology is the weighted aggregation of these 54 days. Some over production can appear when the non-dispatchable productions (also taking into account a minimum power output for must-run technologies) exceed demand. When possible it is stored; otherwise it is curtailed and the load factors of wind and solar are decreased accordingly.

Capacity planning

The planning of new capacities needs to address expected future electricity needs (based on a rolling ten-year extrapolation) while considering the upcoming decommissioning of existing plants (with vintage) and the special contribution of wind and solar (non-dispatchable).

The 648 time-slices per year (54*12) are organised in seven blocks with expected capacity factors of 8760 hours, 8030 hours, 6570 hours, 5110 hours, 3650 hours, 2190 hours and 730 hours. The associated number of full load hours define different total production costs for each of these blocks. This defines the theoretical technology market shares together with coefficients that are calibrated to replicate historical technology mix. Non-dispatchable wind and solare are first determined, in competition with all technologies. However, they don't produce constantly on all seven blocks. Once their capacity is decided (limited by a maximum potential), the remaining need per investment block is updated with the actual production of wind and solar (which is deduced from the current participation of wind of solar in each block).

The dispatchable technologies are then planned based on the remaining capacity needs for each investment block, the theoretical market shares and the resource constraints for some technologies.

In addition to the technologies mentioned in the figure above, one POLES version includes further detail of biomass technologies in the EU, based on work with the GREEN-X model.

Electricity prices

Total production cost is the sum of fixed cost (investment, discount rate, fixed O&M) and variable cost (fuel cost, efficiency, variable O&M), including further taxes or financial support schemes. Investment costs evolve with learning functions (exogenous, endogenous 1 factor, endogenous 2 factors). Efficiency is exogenous. Fuel costs are derived from endogenous fuel prices and assumptions on taxation policies.

Finally the POLES model calculates electricity prices from system production cost for base load (used to set the price for industry) and peak load (used to set the price for residential-services-transport).

Information sources include: Enerdata, Eurostat, IEA, ENTSO-E, ETDB