Fossil energy resources - POLES

| Corresponding documentation | |

|---|---|

| Previous versions | |

| Model information | |

| Model link | |

| Institution | JRC - Joint Research Centre - European Commission (EC-JRC), Belgium, http://ec.europa.eu/jrc/en/. |

| Solution concept | Partial equilibrium (price elastic demand) |

| Solution method | SimulationRecursive simulation |

| Anticipation | Myopic |

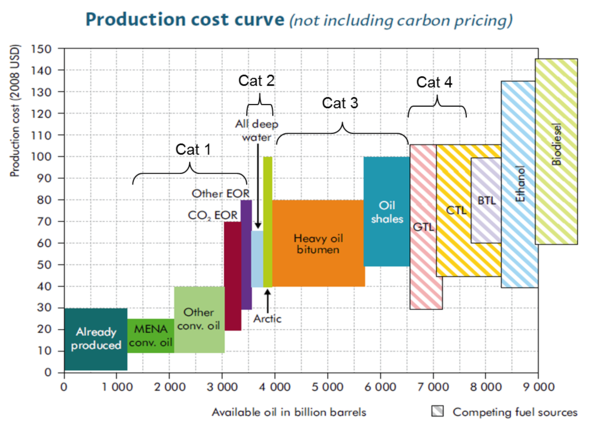

The POLES model differentiates various types of fossil fuels:

- oil: conventional, tar, heavy and oil shale / onland & shallow, deepwater, artic;

- gas: conventional, shale gas / onland & shallow, deepwater and artic;

- coal: steam and coke.

The description below gives elements for oil, but they can be extended to gas and coal.

<figure id="fig:POLES_5">

</figure>

While this figure gives an aggregated static cost curve, the model actually uses dynamic cost curve per resource type integrating the cost of energy needs for production for each production country/ region. Consequently POLES fossil fuel cost curves thus evolve over time, by region and with the scenario settings (for instance: a CO2 pricing will affect the production cost of tar sands).

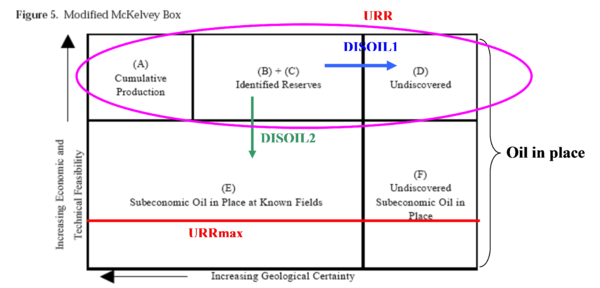

The supply module transforms resources into reserves through discovery effort (exploration and drilling) that depends on remaining resources, the (dynamic) production cost curve and international fuel prices, through elasticities that capture openness to investment and resource management strategies.

Reserves are then turn into production depending on remaining reserves, the (dynamic) production cost curve and international fuels prices.

<figure id="fig:POLES_6">

</figure>

Sources of information include: BGR, USGS, IEA, MIT, industry estimates